Under the OECD’s Pillar 1 (digital economy) tax proposals,[1] many multinational enterprises (MNEs) could be made liable to pay tax in jurisdictions, even if they don’t have a physical presence there.[2] The Pillar 2 Global Anti-Base Erosion (GLoBE) proposals[3] recommend a minimum tax for MNEs. How is Pillar 2 likely to play out in practice and what are the implications for your business?

Building on the Organisation for Economic Cooperation and Development’s (OECD) Base Erosion and Profit Shifting (BEPS) initiative, the Pillar 2 GLoBE proposals are more complex and far-reaching than the seemingly straightforward notion of a minimum tax would suggest. Some sense of how much is involved comes from the fact that the document published for consultation in November 2019 solicited more than 3,000 pages of feedback.

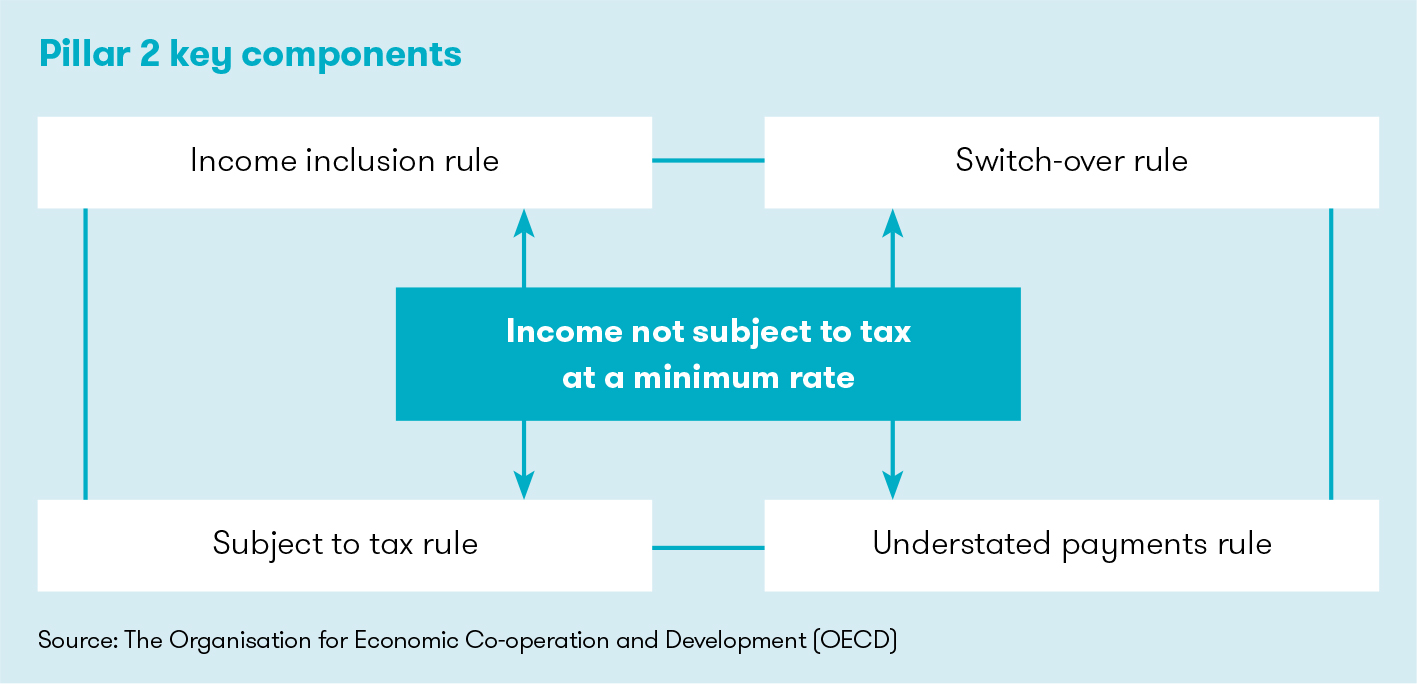

Pillar 2 could be seen as a ‘belt and braces’ for BEPS. It backs up measures to prevent MNEs from diverting taxable income to low tax jurisdictions by imposing minimum tax levels on their global income. That is of course easier said than done and, in practice, Pillar 2 comes down to four key components:

- Income inclusion rule

To tax income of a foreign branch or a controlled foreign corporation (CFC) if that income is taxed below a minimum rate. - Undertaxed payment rule

To deny deduction or impose a withholding tax on payments to a related party if that payment is taxed at below a minimum rate. - Switch-over rule

To support the income inclusion rule that would allow for a switch from an exemption to a credit method where income in a permanent establishment (PE) is taxed locally at a rate that is below a minimum rate. This rule could also apply to immoveable property that is not part of a PE. - Subject to tax rule

To support the undertaxed payment rule by making payments that are taxed at a rate below the minimum rate subject to withholding tax and/or denying treaty benefits to such payments.

Open to question

The proposals open up as many questions as they answer. There is a significant overlap between the four components and it’s far from clear how they will interact. It’s also unclear whether a country will be able to choose how to achieve the Pillar 2 objective of a minimum effective tax.

The income inclusion rule creates several questions, including the level on which it would be applied (parent company jurisdiction, bottom-up, or other), and the in-scope entities. Some challenges addressed by the consultation document include the tax base for the calculation, the ability to blend income streams in the calculation, and specific carve-outs. To date, the OECD has not set out a target minimum tax rate nor has it indicated whether the proposals will apply to all taxpayers or if there will be a carve-out for smaller MNEs.

Practical application

The Pillar 2 consultation document suggests that consolidated financial statements could be used to determine the tax base for global income. This would help avoid the complexity of using a parent company’s tax rules including CFC legislation, which would require re-calculation of profits under multiple tax principles.

However, the use of consolidated financial statements does pose its own challenges:

- Which accounting principles (GAAP) should be used? (US, Japanese, International Financial Reporting Standards or local GAAP).

- The impact of accounting permanent and temporary differences.

- The appropriateness of changes to tax base brought about by a change to accounting principles.

- The ability to audit consolidated financial statements by local taxation authorities.

- The ability to develop a uniform tax base.

More broadly, there are questions over whether reliance on accounting principles is appropriate, given the ambiguity over treatment in some areas, and whether this would unduly influence accounting positions taken.

Blending high and low-taxed income

The consultation document discusses the way foreign taxes could be compared to a minimum effective rate. The ability to blend high-tax and low-tax income from different sources or jurisdictions would simplify the approach to GLoBE, but also reduce its impact. The OECD’s programme of work calls for further discussion on how to find common ground between complexity and impact.

Carve-outs

The OECD has not indicated what exemptions would apply, though it has flagged this for debate. Areas of business and types of enterprise that might be exempted from the provisions could potentially include a carve-out for:

- SMEs

- a small number of related party transactions

- tax regimes which are compliant with the recommendations regarding harmful tax practices (BEPS Action 5)

- specific industries or sectors

- a specified rate of return on tangible assets.

While carve-outs can provide certainty and simplicity for some, they can be complex to administer. Carve-outs based on quantitative factors can also create volatility for taxpayers operating close to such thresholds, especially mid-size MNEs or small but significant local operations.

Will Pillar 1 and 2 work together?

The interaction of the Pillar 1 and Pillar 2 proposals is yet to be seen. Presumably, Pillar 1 would be applied to an MNE prior to applying Pillar 2. Further, it would seem logical that any taxes paid as a result of Pillar 1 would be counted towards the minimum taxes paid on income that are in the scope of Pillar 2. However, this all needs further clarification. Lastly, the interaction with a jurisdiction’s CFC rules need to be considered as otherwise double or triple taxation could arise.

Will it happen?

The Pillar 1 and 2 proposals can only be enacted in their current form if there is an international consensus. Otherwise, there will be simply be divergence, complication and a heightened risk of double taxation.

The possible good/bad outcomes are mixed. In early December, the US Treasury Secretary expressed ‘serious concerns’[4] about whether Pillar 1 (digital taxation) would undermine the arm’s length principle and the related nexus rules. The Secretary also favours a Pillar 2 modelled on the US Global Intangible Low-Taxed Income (GILTI) framework, which would narrow the basis for any global consensus.

The end of the last decade brought in significant tax changes with the OECD’s BEPS initiative that have been implemented broadly. In this decade, the major policy issue is the taxation of digital multinational companies that transact internationally without having a taxable presence in many jurisdictions in which they derive income. Many countries (France, Austria, UK, Italy, Spain and Austria) have reacted by introducing unilateral gross income taxes on digital tax services (DST). These DST create a piecemeal result, increasing compliance burdens and the risk of double or triple taxation. The OECD’s Pillar 1 and 2 proposals offer initiatives that if a consensus is reached amongst countries will yield a more cohesive tax environment for all multinationals. The trade-off to achieve this is the acceptance of a minimum level of taxation.

What you can do now?

- Keep up to date with developments following the latest round of consultations. Political pressure means that resulting measures could be in place, either locally, regionally or globally, very quickly

- Assess the potential for higher and/or double taxation

- Lobby for fair and workable outcomes. For mid-size MNEs, these include clarity over and reasonable exemptions from any measures that would impose a disproportionate burden on limited tax operations

- Consider how Pillars 1 and 2 fit into the wider tax reform agenda, locally, regionally and globally. Are your operations fit for purpose? How can you get up to speed?

For a more detailed discussion of the issues that the Pillar 2 GloBE creates, please consult our detailed comments to the OECD.

We hope that you found this update useful. If you would like to discuss any of the issues in more detail or if you would like assistance modelling how the proposals may affect your business, please contact one of the people listed or speak to your local Grant Thornton office.