8 out of 10 medium-sized companies will not increase their profit margins due to price increases

55% of managers will apply this increase to their products and services in the same proportion

Medium-sized companies quantify an increase in the cost of energy of 34% on average in the last twelve months

57% of businessmen surveyed are in favor of implementing the 4-day working day

The Spanish middle market is concerned about the evolution of inflation, according to the results of the Pulse Express of the Middle Market prepared by the professional services firm Grant Thornton, carried out between the end of May and June 2022. For 59% of the businessmen consulted, the measures applied in Spain are not enough to alleviate the effects of the war in Ukraine and inflation, which stood at 10.2% in June, while for 33% the decisions taken are optimal to reverse this situation.

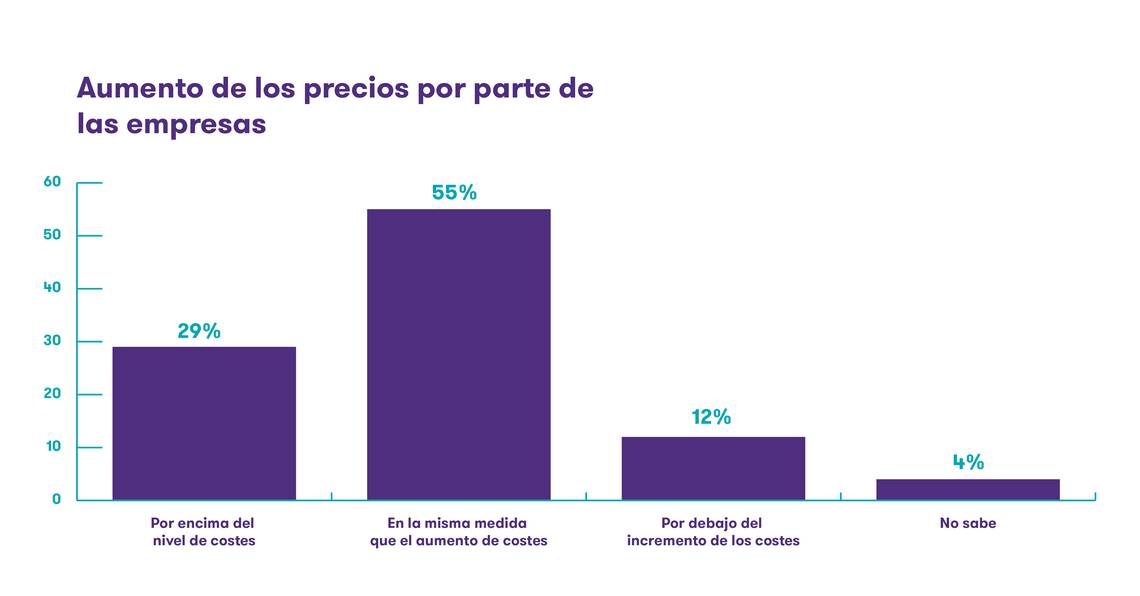

The increase in inflation has forced companies to pass on to the prices of products and services the increase in the cost of raw materials or energy, but, even so, many of them do not plan to obtain profit margins. Thus, 55% of entrepreneurs intend to increase prices in exactly the same proportion as costs, while 12% plan to increase their market share by assuming the loss of margin and increasing prices in a smaller proportion than costs. Less than a third (29%) of the companies surveyed in this study will increase their prices above production costs.

These are some of the main key findings of Grant Thornton's latest Express Pulse of the Spanish Medium-Sized Company, which measures the health of medium-sized companies in Spain, with between 50 and 500 employees, comparing them with those in Europe and the rest of the world based on a methodology developed by Oxford Economics. Every six months, the professional services firm analyzes the prospects and barriers to growth perceived by more than 10,000 executives in 29 countries, 400 of them in Spain.

In addition to these direct price measures, medium-sized companies are considering other decisions to deal significantly with rising costs. Thus, one out of every two companies plans to improve efficiency and internal costs. Limiting external costs and spending on suppliers is also a lever that many entrepreneurs are activating. Forty-one percent plan to do so to contain rising costs, while 30% plan to reduce debt levels or interest. More than a third of companies in our country (37%) are developing action plans and protocols to mitigate the risks of inflation.

For Ramón Galcerán, president of Grant Thornton, "the Spanish business community is making a great effort to design solutions to reduce and mitigate the impact of inflation on rising costs. However, in order to be able to face the worst data of this indicator in 37 years, it is necessary to count on the help of the Administrations, which guarantee that the expenses do not go out of control and endanger the viability of many companies. In addition, it is highly advisable to create business contingency plans aimed at optimizing the entire chain of expenses and operations".

Energy, is the cost that has increased the most for Spanish companies

Despite the fact that prices have increased across the board with respect to the previous edition of the Pulse of the Middle Market, energy costs are the most worrying for businessmen, being one of the items that have increased the most as a result of the war in Ukraine and the sanctions imposed on Russia. The Spanish middle market quantifies an increase in the cost of energy of 34% on average in the last twelve months.

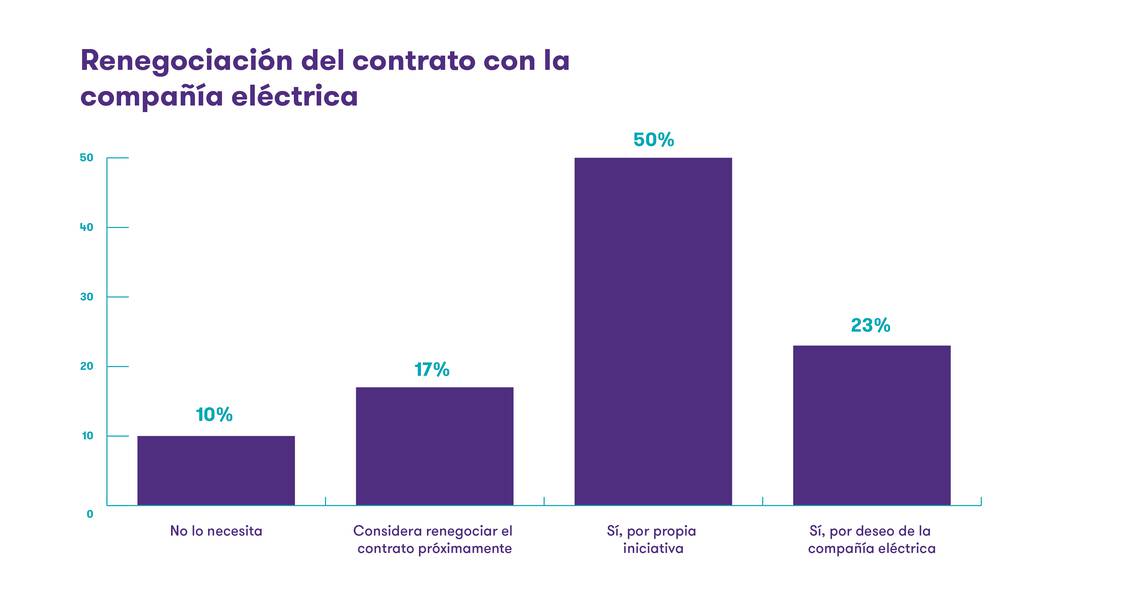

To soften this impact, a large majority of the executives consulted see renegotiating their electricity bill as the main option. Seventy-three percent of companies say they have already done so, while 17% expect to have to renegotiate in the near future. Only 1 in 10 of the companies surveyed consider their current energy bill to be fair.

Alejandro Sanchez, Business Solutions and Energy Partner at Grant Thornton, points out that "rising energy costs are the main problem facing companies at the moment and are the factor that is having the greatest impact on the rest of their cost lines. With electricity bills set to remain high in the coming months as Europe redefines its international supply model and its main sources of energy generation, companies must be able to optimize other areas of their business to offset this runaway expense.

The increase in energy prices has quickly spread to the rest of the input items that businessmen have to deal with. Thus, transport costs, which are closely linked to the increase in fuel prices, have risen by an average of 24%. According to new data from Grant Thornton, the cost of raw materials has also increased over the last twelve months, which has further aggravated their price rally situation as a result of the shock in supply and demand produced during the pandemic. In the last year, companies estimate that raw material prices have increased by an average of 22%.

Spanish medium-sized companies also account for the increase in other structural costs such as staff salaries, which have risen by 14% on average in the last 12 months. Similarly, banking costs and capital goods have increased their costs by 17% and 16% respectively.

Good business acceptance of the four-day working day

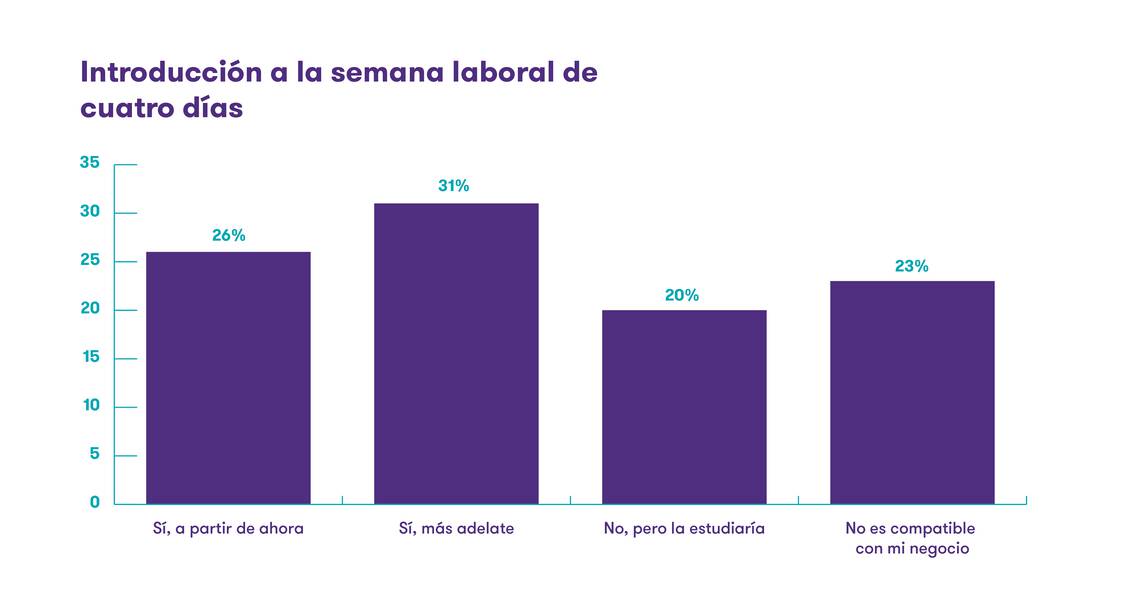

The Pulse Express of the Medium-Sized Company also includes other questions related to the current economic and business situation in our country. Thus, it is worth highlighting the good reception and acceptance among the businessmen consulted by Grant Thornton of the introduction of the four-day working week. More than half of the businessmen surveyed (57%) agree to implement it now or at a later date. Twenty percent are not in favor, although they acknowledge that they would study the measure. Only 23% of companies consider that the 4-day working week is not compatible with their business.

The current political climate in our country was another of the issues analyzed and raised with the Spanish business sector. For 41%, the political situation is detrimental to their business, while 36% consider it to be favorable. Some 23% say that it does not affect the development of their business at all.

The Express Pulse of the Spanish Medium-Sized Company also asked to what extent the Spanish business sector has been able to access the European Funds injected from Europe on the occasion of the arrival of the Next Generation Funds and other alternative funds also offered by the European Union. Only 9% of entrepreneurs say they have already had access to all the aid requested, while 26% have only been able to access 50% of the funding requested and 18% have only been able to access less than half of the funds requested. Some 23% are still planning to apply for this aid, although they have not started the process, and 24% consider it lost and are not going to start any application process in this regard.

For Mario Carabaño, Partner of Public Sector Consulting and Digital Transformation at Grant Thornton, "Despite the substantial aid from European funds, many small and medium-sized companies are not aware of the Next Generation EU Funds. In addition, we observe that the deadlines to receive the grants are delayed in time and the funds are arriving in our country slowly. It is necessary to accelerate this funding process to boost the digital and green transformation that many companies need and that marks the Spanish and European recovery plan itself."

In terms of future investment, 4 out of 10 plan to invest in innovation and development (R&D), while 39% plan to allocate part of their investment to digital transformation. Promoting internationalization is another area where the future budget of many companies will be allocated: 3 out of 10 already plan to invest in order to be able to sell more abroad. The environmental and social areas also account for part of the investment. Twenty-eight percent of executives will finance actions aimed at protecting the environment and combating climate change, while 17% will invest in biodiversity protection and gender equality.

This Express Pulse of the Spanish Medium-Sized Company is the prelude to the results of the Pulse for the first half of 2022, which Grant Thornton will launch in September, and which measures the health of the Spanish medium-sized company on a scale of +50 (excellent health) and -50 (deteriorated health).