Local relationships, global knowledge

We are risk advisory professionals covering wide range of risks in financial industry. Our advisory approach is based on in-depth quantitative knowledge and analysis always aligned to key regulation and best industry standards.

Our international engagements are significantly broadening our knowledge base and market insights which is essential component of our advisory services. The international nature of our business model allows us to access best in class professionals in Europe and leverage of great intellectual capital in the industry.

We can offer the following services to the market.

|

Quantitative Risk |

Climate & |

Prudential Risk |

|

Governance, Risk & Compliance (GRC) |

Business Risk Services |

Digital Risk |

Quantitative Risk Services

Our quantitative risk team in Spain is an integral part of the fast growing international quant risk network. In our engagements we work directly with offices across Europe which provides us with huge flexibility and scale to support our clients.

The financial services industry is characterised by increasing complexity, whether that is investment products, credit offerings or regulatory requirements.

Financial institutions are critically dependent on accurate risk modelling to keep pace with this increasing complexity as ‘data-driven’ approaches affect institutions’ business strategies, risks, operations and regulatory obligations.

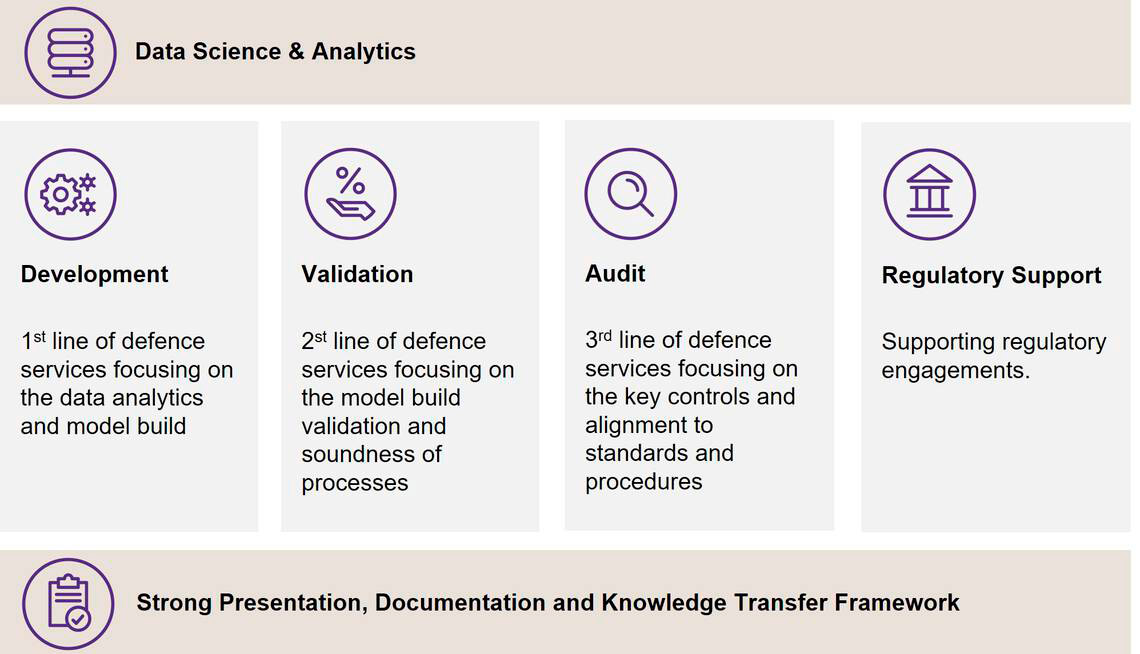

Our Quant Risk Services offering includes:

Stress Testing & Forecasting, ICAAP, ILAAP, P2 Models

We consider data and data quality to be the cornerstone of any successful project. This is why we approach data with the highest attention to detail, and use leading software, technology and methods for data collection, analysis and visualization.

The Quality of our work is guaranteed by the quality of our people

We employ the best professionals in on the entire European market and at the same time we are very proud of our internship and graduate programs that help us to raise the high profile professionals who are helping us to shape the banking industry worldwide.

Quant Risk Team Profile

|

Finance & EconometricsWe are passionate about our Research & Publications and proud to contribute to overall industry knowledge |

Mathematics & StatisticsWe master all coding languages R, R Shiny, Python, VBA, SQL, SAS … |

Qualifications FRM, CFAWe enjoy building toolkits and off the shelf solutions |

Bachelors, Masters & PHDs• We appreciate honesty and transparency |