In continuity with the urgent measures approved by the Spanish Government to mitigate the crisis generated by the Covid-19, on May 5, 2020, Royal Decree Law 17/2020 of May 5 was published in the Official State Gazette, approving support measures for the cultural industry and tax measures to deal with the economic and social impact of the Covid-2019, which entered into force on May 7, 2020.

Regarding taxation, the main measures approved are as follows:

Corporate Income Tax: increase in tax incentives related to film production (deduction for investments in film productions and audio-visual series)

In order to promote and facilitate private investment, as well as to encourage the competitiveness of the Spanish film and audio-visual industry in the national and international environment, Article 36 of Law 27/2014, of November 27, on Corporate Tax, is modified, increasing the tax credits related to film production, with effect for tax periods starting on January 1, 2020, in the following terms:

- Increase in the percentage of tax credit for investments in Spanish productions of feature films, short films and audio-visual fiction, animation or documentary series, that allow the preparation of a physical support prior to their industrial production.

The deduction is extended to allow its application to investments in Spanish productions of short films.

The applicable deduction is increased as follows:

- From 25% to 30% with respect to the first million of the deduction base.

- From 20% to 25% of the excess amount.

The amount of this deduction is increased. This deduction may not exceed 10 million euros (instead of the previous limit of 3 million euros).

The combined limit of the tax credit for investments in film productions and audio-visual series with the other subsidies received by the taxpayer remains at 50% of the total production cost. However, this limit is raised to:

- 85% for short films.

- 80% for productions directed by a person who has not directed or co-directed more than two feature films qualified for commercial exploitation in film theatres, whose production budget does not exceed 1,500,000 de euros.

- 80% in the case of productions shot entirely in one of the co-official languages other than Spanish and screened in Spain in that co-official language or with subtitles.

- 80% in the case of productions directed exclusively by persons with a degree of disability equal to or greater than 33% recognised by the competent body.

- 75% in the case of productions directed exclusively by female directors.

- 75% in the case of productions with special cultural and artistic value that require exceptional financial support in accordance with the criteria established by Ministerial Order or in the corresponding announcements of aid.

- 75% in the case of documentaries.

- 75% in the case of animation works whose production budget does not exceed 2,500,000 euros.

- 60% in the case of cross-border productions financed by more than one Member State of the European Union and in which producers from more than one Member State participate.

- 60% in the case of international co-productions with Latin American countries.

- Increase in the percentage of deduction for producers registered in the Administrative Registry of Film Companies of the Institute of the Cinematography and Audio-visual Arts (“Registro Administrativo de Empresas Cinematográficas del Instituto de la Cinematografía y de las Artes Audiovisuales”) who are responsible for the execution of a foreign production of feature films or audio-visual works that allow the preparation of a physical support prior to their industrial production.

The deduction applicable is increased from 20% to 30% with respect to the first million of the deduction base and 25% on the excess of this amount.

The base for the tax credit continues to be the expenses incurred in Spain, provided that these expenses amount to at least EUR 1 million. However, a specific reference is included for pre-production and post-production expenditure on animation and visual effects made in Spanish territory, which is limited to 200,000 euros.

The amount of this deduction is increased. This deduction may not exceed 10 million euros (instead of the previous limit of 3 million euros).

Personal Income Tax and Tax on the Income of Non-Residents operating in Spanish territory without a permanent establishment: increase by 5 percentage points the percentages of deduction provided for donations made

With the aim of increasing citizen participation in the financing of sponsorship projects, article 19 of Law 49/2002, of 23 December, on the tax regime for non-profit organisations and tax incentives for sponsorship, is amended with effect from 1 January 2020, in the following terms:

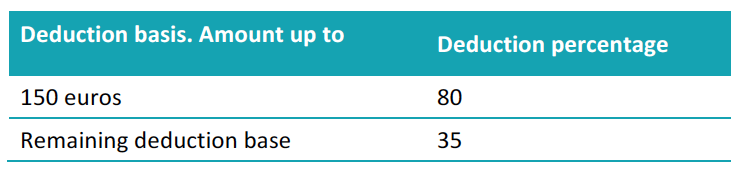

The percentage of deduction from the total tax liability is increased by 5 percentage points in accordance with the following scale:

In addition, if in the two immediately preceding tax periods donations, gifts or contributions with a right to deduct have been made to the same company for an amount equal to or greater than that of the previous year, the percentage of the deduction applicable to the base of the deduction in favour of the same company that exceeds 150 euros is also increased by 5 percentage points, from 35% to 40%.

Programs to support events of exceptional public interest.

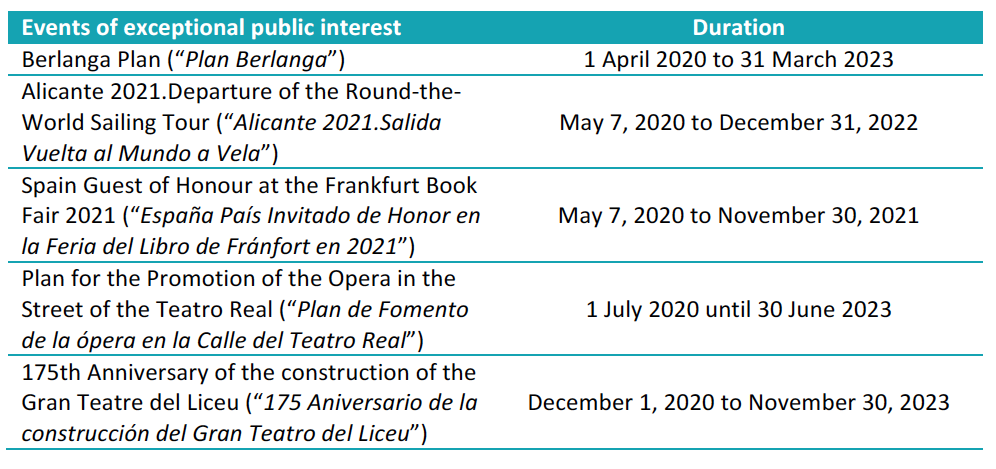

It also regulates new events of exceptional public interest and extends the term of other existing programmes that may be subject to the tax benefits established in Law 49/2002, of 23 December, on the tax regime for non-profit organisations and tax incentives for sponsorship.

In this regard, the following are introduced as new events of exceptional public interest:

The duration of support is also extended for the following events: